Market Research & Business Valuations

Elevating Perspectives: Advanced Market Research and Business Valuation Solutions

In the dynamic world of corporate finance, business valuation holds a pivotal role. It involves assessing factors like management effectiveness, capital structure, future earnings potential, and asset market value. Using various tools—from analyzing financial statements to employing discounted cash flow models—valuators delve into each business’s distinct characteristics. Through thorough examination and comparison, they uncover the true essence and potential of the business, guiding strategic decisions and shaping its future.

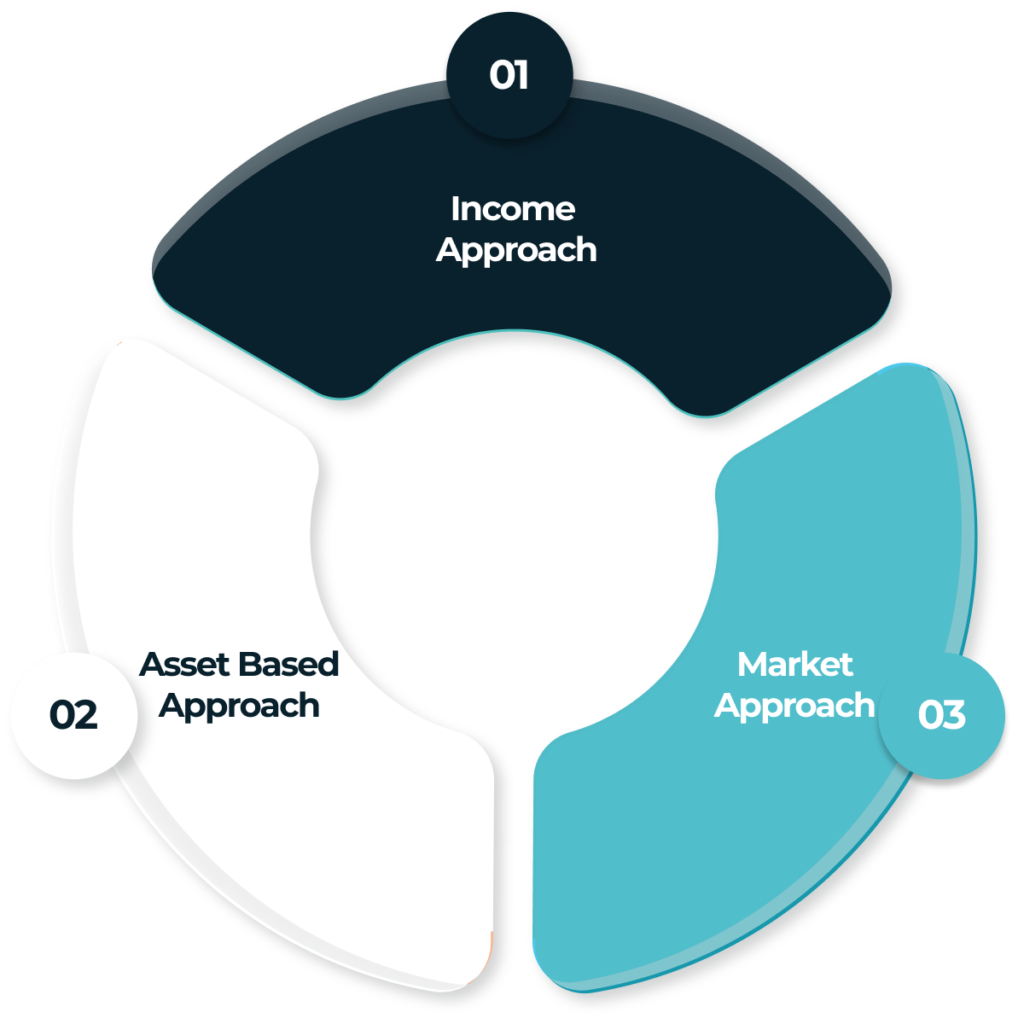

Valuation Methodologies

Applying diverse valuation methods to unveil the true worth of your business, ensuring precision and accuracy.

Key Value Drivers

Identifying and prioritizing key factors such as market positioning, revenue growth, and operational efficiency to drive optimal value for your business.

Research Methodologies

Blend qualitative and quantitative approaches to glean comprehensive insights tailored to your business needs.

Market Exploration: Unveiling Insights for Strategic Growth

In our market research endeavors, we delve into various methodologies to gather insights, including qualitative and quantitative approaches. These methodologies, tailored to the unique characteristics of each project, provide a comprehensive understanding of market dynamics and consumer behavior. Our adept analysis ensures informed strategic decisions that propel businesses toward their objectives.

Valuation Insight: Guiding Strategic Decision-Making with Precision Analysis

In our valuation assessment, we explore two widely accepted methods for business valuation: the Income Approach and the Market Approach. Although both hold merit, the specific nature of the subject business and the goals of our analysis dictate the most suitable approach or combination thereof. Our expertise ensures a nuanced understanding, leading to informed and strategic valuation decisions.